[Source: "High-tech LED - Research Review" October issue GLII]

Entering 2012, the LED industry in Taiwan, China, is generally facing a sharp drop in the prices of mid-upstream products, and has not been able to break out of the break-even point. Under this circumstance, LED manufacturers have no choice but to actively seek change, and seek self-help through strong alliance.

The High-Tech LED Industry Research Institute (GLII) believes that the market prospects of LED manufacturers in Taiwan will not be optimistic in the future.

Industrial chain advantage or disintegration

At present, the LED industry in Taiwan is facing multi-faceted attacks from Europe, the United States, Japan and South Korea, as well as mainland LED companies. Most of the market share previously occupied is being eroded by companies in the above countries and regions.

In terms of sapphire substrates, mainland capacity began to be released this year, and Korean sapphire manufacturers are also expanding capacity on a large scale. According to GLII statistics, the total shipments of seven sapphire substrate manufacturers in Taiwan in the first half of this year were approximately 8.88 million units, a year-on-year increase of 29%. However, due to the unfavorable factors such as the sharp decline in sapphire prices and the continued low position, only the top three companies in the first half of the year were Jingmei Application, Zhaoyuan Technology and Ruijie Technology.

On the chip side, LED chip makers such as South Korea's Samsung and China's Sanan Optoelectronics are rapidly shrinking the capacity and technology gap with LED chip manufacturers in Taiwan, especially in the LED backlight and lighting market. Multi-party and Taiwan LED chip manufacturers have already launched a positive market. Confrontation.

According to GLII statistics, in the first half of this year, the total revenue of 10 LED chip manufacturers in Taiwan was 4.92 billion yuan, down 16.5% year-on-year. In the case of a sharp drop in chip prices, the only profitable companies are Guangsheng and Guanglei, with net profits of 15 million yuan and 36 million yuan respectively. In the same period last year, six chip manufacturers including Jingyuan and Yuyuan achieved profitability. Taking Jingyuan Optoelectronics as an example, in the first half of 2011, it achieved a profit of 232 million yuan, but in the first half of 2012, it lost a loss of 0.29 billion yuan.

In terms of packaging, in the first half of this year, 15 Taiwan LED packaging manufacturers achieved a total revenue of 5.818 billion yuan, down 1% year-on-year. In terms of profitability, eight packaging companies achieved profitability in the first half of the year, and seven manufacturers suffered losses.

At the same time, this year's mainland LED packaging technology and production capacity has been greatly improved, and further promote the cost-effectiveness of packaging products. Whether it is backlight or lighting products, the advantages of mainland LED packaging manufacturers are becoming increasingly obvious.

The fierce market competition has led to the continued downward channel of upstream and downstream LED products such as sapphire, chips and packaging. Judging from the current operating conditions, most of the enterprises in the middle and upper reaches of LED in Taiwan this year will face the difficult situation of profitability. At present, the LED industry has entered the stage of low-price competition. For most Taiwanese LED manufacturers who have not been able to turn a profit, the choice of mergers and acquisitions and other integrated means has become the best choice for maximizing profits in the context of “industry winterâ€.

Enterprises actively seek change

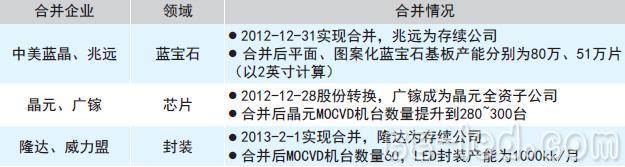

On September 13, 2012, Lunda Electronics and Powerex Electronics announced that the two companies had merged through a share swap, with Lunda as a surviving company. This is another major merger in the LED industry in Taiwan after the merger of Sino-US Blue Crystal and Zhaoyuan, Jingyuan and Guangjia.

This year's three major mergers involved three areas of sapphire substrate, chip and packaging, showing that the LED industry chain in Taiwan has a collective survival crisis, and each company hopes to merge to seek market concentration and indirectly reduce production costs. . At the same time, a series of mergers is also a true portrayal of the difficult situation of the LED industry in Taiwan this year.

The merger of LED manufacturers in Taiwan is intended to be active.

Table 1 Consolidation of Taiwan LED manufacturers in 2012

GLII believes that the most important purpose of a series of mergers is how to reduce the low cost in the current unfavorable situation of oversupply. Through the merger, the LED resources between the two companies that were originally competitive can be fully integrated, reducing duplication of investment, increasing the efficiency of production and procurement, and expanding the seaport.

For sapphire, the one-stop manufacturing model from crystal growth, substrate to PSS can reduce the cost of the enterprise. Previously, Sino-US Blue Crystal had long crystal technology and its products were mainly based on PSS. Zhaoyuan focuses on sapphire substrate cutting, and PSS is relatively small. After the merger of the two, not only formed the entire industrial chain manufacturing model, but also the scale benefits have been greatly improved.

On the chip side, compared with the dilemma of low-end LED products, the demand for high-end LED chips for LED backlighting and lighting is still quite large. However, the current global investment in high-end LED production capacity is approaching saturation. In addition to the acquisition of Guang-Guang, Jingyuan Optoelectronics can reduce the excess investment in equipment and avoid the overcapacity caused by repeated investment.

In terms of packaging, Ronda has basically completed the vertical integration of the industry chain, while Power League is good at manufacturing and sales of LED packaging and lighting products. It is the largest T5 lamp supply of China Electric Co., Ltd. (hereinafter referred to as “CLPâ€). Business. After the merger of the two parties, the cooperation relationship between Ronda and CLP will be deepened, and the original advantages of the two sides in the LED lighting market in Taiwan will be further enhanced.

In terms of the internal and external environment of industrial development, the rapid rise of Korea and the mainland LED industry has created a huge external impact on the LED industry in Taiwan. Internally, the pattern of Evergrande, the largest LED industry in Taiwan, has gradually become clear. The crowding out effect of large manufacturers on small and medium-sized manufacturers is becoming more and more obvious, which will further squeeze the living space of small and medium-sized LED manufacturers.

GLII predicts that the integration of the LED industry in Taiwan will continue under the influence of both internal and external adverse factors.

elastic nylon watch straps, high quality nylon watch straps,nylon watch strap belt,custom nylon watch straps

Dongguan Yingxin Technology Co., Ltd. , https://www.yxsparepart.com