On the 22nd of this month, Tencent’s largest shareholder, South Africa’s Naspers (South African Newspapers), sold 2% of Tencent’s shares, and for the first time in more than a decade, it reduced its shareholding in Tencent. This operation caused an uproar in the market: Tencent's share price fell 5% on the day, the stock price reported 439.4 Hong Kong dollars, and the market value evaporated 200 billion Hong Kong dollars.

However, in just five days, Tencent’s stock ushered in the second major shareholder and executive reduction.

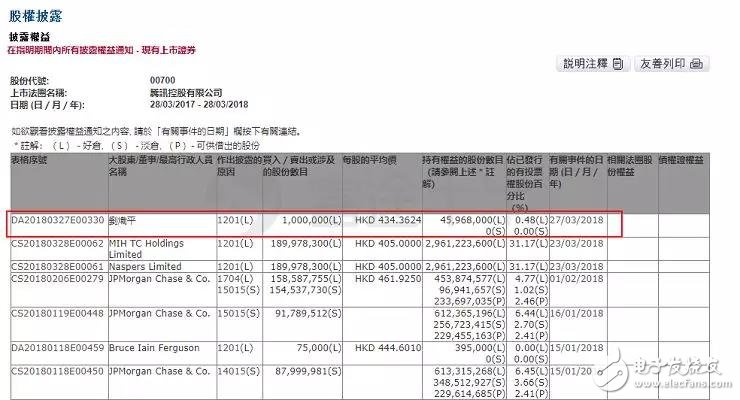

On March 27, Liu Chiping, president of Tencent Holdings, reduced the holding of Tencent shares by an average of 434.3624 Hong Kong dollars, worth about 434 million Hong Kong dollars, equivalent to 348 million yuan. After the reduction, Liu Chiping held a 0.48% stake in Tencent.

Moreover, last Wednesday (March 21), Tencent Holdings announced its 2017 annual results, Tencent has fallen from the recent high of 475.6 Hong Kong dollars per share, despite the recent rebound, but affected by the decline in global technology stocks, On March 28, the closing price was HK$412.2 per share, down 4.63%. The stock price has fallen by 13.3% in just one week.

The financial report released by Tencent shows that the annual net profit is 71.5 billion, up 74% year-on-year. The fourth quarter revenue is 66.39 billion. Although it still looks glamorous and domineering, it is actually a good song for Tencent. A poor financial report. After all, analysts estimate that the fourth quarter revenue is 68.61 billion.

Then the question is coming. Is there behind this series of twists and turns, or is it a signal? Let us briefly discuss one or two.

Main business encounters ceiling

Tencent's share price plummeted for two consecutive days. This is inseparable from the factors that the major shareholders decided to reduce their holdings. It is also inseparable from the opening of the Sino-US trade war, but it is also inextricably linked to its core game business.

Tencent's just-released financial report shows that in 2017, Tencent's revenue in the game business was 117.8 billion yuan, a year-on-year increase of 41.7%, and Tencent's mobile game revenue was 62.8 billion yuan, an increase of 63.5%.

The results are still quite good, but if you look at the fourth quarter alone, it should be easy to find the problem.

The financial report shows that in 2017, Q4 Tencent's game revenue was 29.7 billion yuan, a decrease of 9.45% from the previous month.

Tencent did not mention the exact data on individual game products in the report. It only indicated that the overall mobile game “ARPU (average revenue per user) decreased), and the expression of the most attention-grabbing chicken game was also vague. “Perfect performance†and not “commercializationâ€.

However, it is easy to see that the main reason for this result is obviously the decline in the mobile game business. The financial report shows that the Tencent mobile game Q4 has dropped by 7.14%, which is to know that this is Tencent mobile game in 2015. After Q2, the first time the ring ratio decreased.

For the mobile game's decline, the point is straightforward: this directly means that Tencent's entire game business is beginning to touch the ceiling. This may be an important reason for the direct fall in stock prices.

New retail anxiety

On October 13, 2016, Ma Yun proposed the concept of “new retailâ€. By March 21, 524 days, Tencent announced the “smart retail†strategy.

This also means that the two giants will begin to compete in the online retail market.

According to the financial report, the revenue of Tencent's new retail segment increased by 153% year-on-year in 2017, reaching 43.338 billion yuan, accounting for 18.2% of total revenue. And in the past three quarters, it has achieved three-digit growth, and the results are good.

However, Analysys released the third-party payment mobile payment market share data for the third quarter of 2017. In the third quarter of 2017, Alipay's market share was 53.73%, an increase of 3.3 percentage points year-on-year; TenPay (including WeChat payment) market share was 39.35%, an increase of 1.23 percentage points over the same period.

Therefore, it can be seen that in the battlefield of mobile payment, the amount of payment treasure is still larger than WeChat, and the growth rate also exceeds WeChat payment. This is not a good trend for Tencent.

Moreover, from the turbulent Wal-Mart incident that was fired a few days ago, we can easily see some anxiety.

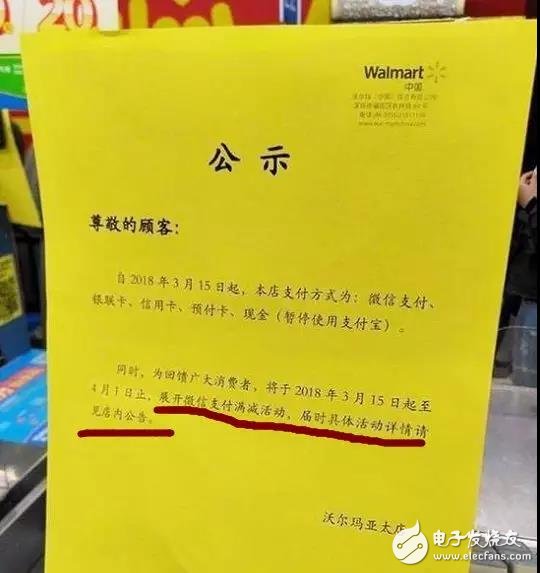

From March 26th, when customers shop at Wal-Mart, they found that some stores suspended Alipay and only supported WeChat payment. Wal-Mart responded “this is a commercial decisionâ€. Later, "step by step" also joined the camp, causing a large number of consumers dissatisfied.

Although the competition between several giants in mobile payment has always existed, it is probably the first time that this has broken the enthusiasm and put things directly on the table.

Moreover, at the just-concluded China IT Leaders Summit, Ma Huateng said that “deciphering†Tencent Smart Retail, which has not seen the outside world, said that a big purpose is “good for payment.â€

It is worth mentioning that, six months ago, Ma Huateng said to everyone at the platform of Tsinghua University: "Everybody sees the mobile payment on the street, we don't really exclude another one, and vice versa."

From the point of view of Wal-Mart, Tencent seems to be a bit happy, but in the face of the opponent's nearly double-speed growth, in addition to increasing and preempting various types of entity payment scenarios, there is no other way.

Since last year, Tencent has “selled coins†for tens of billions. It has invested in Yonghui, Wanda and Haishu homes, and signed a letter of intent with Carrefour China with Yonghui, and reached strategic cooperation with BBK, but this forced It is hard to say whether the behavior of the business team will cause a counterattack.

Therefore, although in the new retail, who will win in the end, we are not too early to judge, but have to say that in the face of strong opponent Ali, Tencent is a bit anxious.

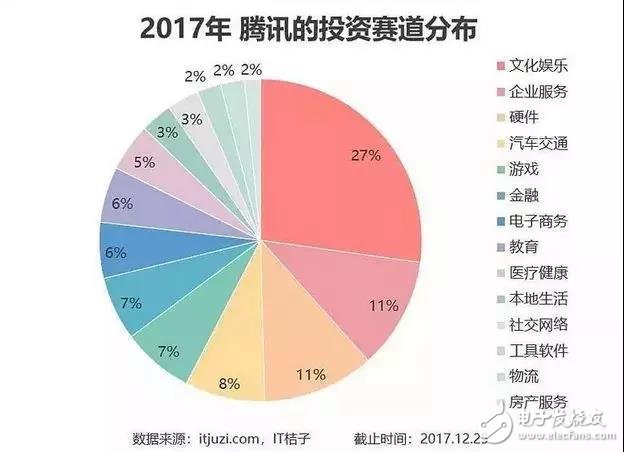

Insufficient new business scenarios

As we mentioned above, Tencent's game is the core business, but for a company like Tencent, the game is over-represented, which may not be a good thing. The so-called "Cheng Xiao Xiao He Xiao He" may be the case.

A Hong Kong stock analyst told the Beijing News reporter that for Tencent, "Glory of the King" has mobilized almost all traffic resources, attracting a large number of mobile game users, and it is not easy to replicate this success in other games. The life cycle of mobile games is much lower than that of end games, and the new game will eventually divert old gamers.

So this means that the development of Tencent's games has indeed reached a new stage, and the growth rate will inevitably slow down.

In addition to games, Tencent's other main income is social network and advertising revenue. The financial report shows that the two together account for 40.6% of Tencent's total revenue, close to the game business. For Tencent, WeChat and QQ User size is becoming saturated.

Tencent, the king of traffic, can still rely on this wave of dividends, we don't know.

Relatively single business scenario has already attracted the attention of Tencent's top management. Ma Huateng began to give investors a shot. When the earnings report was released, he said: "We are increasing dramatically in video, payment, cloud, artificial intelligence and smart retail. Investment in other fields will have some impact on our earnings in the short term, but we believe that these investments will bring us long-term value and growth opportunities."

However, for investors, long-term value and immediate interests, which one they really want, is not very good to say.

Tencent's march into the blockchain is true!Although Tencent will not touch ICO and digital currency, Tencent’s entry into the blockchain is true.

In April 2017, Tencent released the "Blockchain Solution White Paper" - Trusted Blockchain TrustSQL. At the same time, the Tencent blockchain industry solution with independent intellectual property rights was officially released on the official website. According to the official website of the Trademark Office of the State Administration for Industry and Commerce, Tencent has quietly registered the trademarks “Ether Lock†and “Tencent Ether Lockâ€.

On March 10, Cai Yunge, general manager of the blockchain business of Tencent, said that as early as three years ago, Tencent had started to build a blockchain R&D team and successfully made blockchain technology in a series of industry scenarios. In addition, Tencent also launched the blockchain open platform BaaS. In 2018, Tencent will increase the exploration of blockchain and supply chain finance. According to the information disclosed by Cai Yuge, the blockchain technology of Tencent has been applied in the fields of supply chain finance, Tencent micro gold, logistics information, legal deposit, and public search.

At present, Tencent Micro Gold has accumulated more than 40 million transaction records in the blockchain; the public interest tracing platform has accumulated more than 300 tracing cases; the legal depository platform has also docked several banks. The deposit certificate is currently in a stage where more points are gradually blooming.

According to Cai Yige, the media also revealed: “The blockchain belongs to a section of Tencent’s innovative business. Similar to AI, the blockchain is also starting from technological innovation, and it may have an impact in different fields in the future. Tencent from the beginning It is from the bottom of the technology platform, at present on the one hand solid reserve technology foundation, on the other hand is actively exploring the landing of more valuable scenarios."

In addition to TrustSQL, He Wei also discovered Tencent's other blockchain product, Tencent Blockchain as a Service.

TencentBlockchain as a Service, a cloud service based on blockchain technology built on the financial cloud. The TBaaS platform system not only meets the financial level of security compliance requirements, but also has the complete capabilities of Tencent Cloud, users can quickly build their own IT infrastructure and blockchain services on a flexible, open cloud platform. TBaaS Tencent Cloud Blockchain Open Platform supports the Hyperledger Fabric blockchain network technology, and will support the underlying technologies of BCOS, TrustSQL, Corda, EEA and other blockchains, and open up the surrounding technology ecosystem for users based on the block. Chain development, testing, and rapid deployment provide a complete enterprise-level solution.

Cai Weige, general manager of the blockchain business of Tencent. He graduated from the Computer Science Department of Nanjing University in 2004 and has served Tencent for more than 10 years. Before and after the history of technology, product planning, product operations and other positions, Tencent FiT financial product innovation laboratory senior director, P4 product experts, Tencent blockchain business leader.

Before serving as general manager of the blockchain business in Tencent, Cai's highest position should be the senior director of Tencent FiT Financial Product Innovation Lab. FiT is the abbreviation of Tencent's payment basic platform and financial application line "Financial Technology" in English. It is a comprehensive platform for Tencent Group to provide users with Internet payment and financial services. Its predecessor began in Tenfu, which was established in 2005, and was officially upgraded to “FiT†in September 2015. Based on the two platforms of WeChat payment and QQ wallet, FiT connects users, merchants and financial institutions.

In combination with the previous speech by Cai Weige in an exclusive interview with the media, it is difficult for us to understand that the Tencent blockchain open platform should be financially oriented. "Tencent will increase the exploration of blockchain and supply chain finance. At the same time, Tencent will continue to explore the ABS platform, virtual digital assets and other fields."

Compare the discovery of Tencent cloud blockchain. TrustSQLBaaS: Pay more attention to the development of the underlying technology, what is to be done is the underlying technology platform of the blockchain. Provide underlying technical services for a variety of blockchain applications.

Tencent Cloud Blockchain Service TBaaS: Emphasizes the application layer, provides blockchain basic resource services for third-party users, reduces user entry barriers, and encourages enterprise or individual developers to deploy applications to TBaaS.

But there are many similarities between the two in the underlying technology and application scenarios. Is this technology internal sharing? Synchronous support?

He Wei believes that in the exploration of the blockchain field, Tencent still adopts the development strategy of Tencent's internal multi-team exploration, internal competition and preferential support. TrustSQL BaaS and Tencent Cloud Blockchain Service TBaaS are just two directions that Tencent has publicly revealed. Internally, there should be more teams doing blockchain-related exploration work.

Products Description :

TTN Power inverter offer superior quality true sine wave output, it is designed to operate popular power tools and sensitive loads. Connect pure sine wave inverter with battery terninals, then you can get AC power for your appliances, the AC output identical to, and in some cases better than the power supplied by your utility.

Products Features :

- Input & output fully insolated.

- High Surge: high surge current capability starts difficult loads such as TVs,camps,motors and other inductive loads.

- Grounding Protection: there is terminal in front panel, you can grouding the inverter.

- Soft start: smooth start-up of the appliances.

- Pure sine wave output waveform: clean power for sensitive loads.

- AC output identical to, and in some cases better than the power supplied by your utility.

- Cooling fan works automatically when inverter becomes too hot, it turns off automatically when the temperature is reduced.

- Low total harmonic distortion: below 3%.

- Two LED indicators on the front panel showthe working and failure state.

Power Inverter,Modified Sine Inverter,Modified Square Wave Inverter,Modified Or Pure Sine Wave Inverter

zhejiang ttn electric co.,ltd , https://www.ttnpower.com