The iPhone-driven touch craze has enabled mobile phone users around the world to quickly accept this new human-machine interface. Seven years after the advent of the first generation of iPhones, Apple again brought innovation to the touch market with the iPhone 5 in 2012. The iPhone 5 with In-Cell embedded touch technology has reduced the thickness of a piece of glass by 35% compared to the previous generation iPhone 4S. Its thinner and lighter design has once again set a new design benchmark for smartphones, There has been an upsurge in large-scale touch module manufacturers investing in monolithic glass solutions (OGS).

Since Apple introduced the touch experience to iPhone and iPad, touch technology has revolutionized the application of consumer electronics in the past few years. Since 2009, the average growth rate of the touch screen market has been higher than 30%. At the same time, with the continuous innovation of products, touch technology has also continued to make breakthroughs.

Driven by the thin and light trend, projected capacitive and embedded touch technologies such as OGS, On-cell, and In-Cell have gradually emerged, and the touch experience has been continuously extended from mobile phones and tablets to notebook computers, All -in-one PC and other medium and large size fields have opened a broader application prospect for future consumer applications.

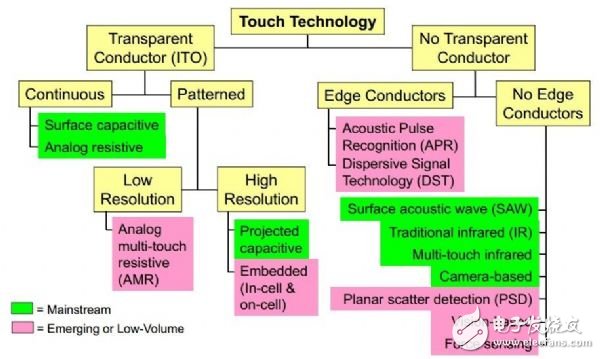

Current development of mainstream touch technology. (Source: Intel, Display Week 2013)

Touch technology market trends

Looking back at the development of touch panels, there have been several major turning points since 2011. The rapid popularity of smartphones has forced manufacturers to speed up their research and development. The parity of mid- to high-end smartphones has also increased the demand for low-cost touch panels by brand owners.

In a smart phone, the touch panel accounts for about 8% ~ 12% of the cost; in tablet devices, it accounts for 30% ~ 40%, plus the results of the high homogeneity of high-end mobile phones, screen resolution and performance It has also become the focus of mobile phone manufacturers' pursuit of differentiation, which has inspired touch panel module manufacturers to actively develop OGS technology to seize the business opportunities of emerging affordable smartphones.

According to the structure of the touch panel, there are two mainstream architectures in the market: in-cell and out-cell. The built-in structure is In-cell and On-cell; the plug-in type includes from the resistive type to the projected capacitive technology that has become the mainstream and has multi-touch function. The production structure has changed from the traditional two OGS of sheet glass (GG) or glass film (GFF) type turning to single glass.

The built-in touch technology can be thinner and cheaper than traditional plug-in touch panels because it reduces a layer of touch glass. The sensing circuit of the In-cell technology is located directly inside the display panel, while the sensing circuit of the On-cell technology is made on the color filter of the display panel or the surface of the AMOLED package glass.

Currently, On-cell technology is mainly applied to AMOLED panel products. Although In-cell has problems of cost, yield, and noise interference during LCD driving, it has been adopted by Apple and Sony smartphones. However, the production threshold of In-cell touch technology is quite high, and they are all in the hands of panel manufacturers. In addition, they still face the process yield challenge. Most of them are currently used in smartphones with a size of about 4 inches. distance.

However, since Apple is the first company to adopt In-cell technology, this move has a huge impact on the touch technology industry chain. In view of Apple's huge influence on the mid-to-high-end smartphone market, the industry is still optimistic about the development prospects of this technology in the future of small-sized mobile phones despite the fact that In-cell technology still faces yield challenges. According to NPD DisplaySearch statistics, In-cell touch panels accounted for 7.3% of mobile phone panel shipments in 2012, but this year the number is expected to grow to a multiple of 13.7%, while GG DITO (single-glass double-layer circuit used in the past) Structure) The proportion of technology will decrease from 10.3% to 0.6%.

In addition to the embedded technology, the OGS technology currently concerned by many module manufacturers is also expected to play a key role in the future touch market. OGS is a solution developed to meet the consumer's demand for thinner and lighter terminal devices. It integrates the sensing circuit substrate with the surface glass and directly produces the sensing circuit on the surface glass, which not only reduces the use of a glass substrate It can also reduce a laminating process. Compared with GG technology, the thickness can be reduced by about 0.4 mm, and the cost can be greatly reduced.

In fact, since 2013, the touch market has undergone significant changes driven by the thin and light trend. The GG solution, which previously accounted for more than 30% of the market, was gradually replaced by the OGS solution of single-piece glass. With the influential in-cell In-cell technology, the touch screen companies began to adjust their production strategies and joined the development of OGS capacitive touch Control the ranks of the screen.

However, the development of OGS has not been smooth. Initially, the results of the OGS touch technology solution in the field of portable mobile devices were not as expected. The main reason is that the strength of its protective glass is insufficient to meet the needs of mobile phones and other products that often move. But another advantage of OGS is that it can meet the needs of large-scale applications. In the field of touch, the larger the size of the panel, the higher the cost, and the higher the impedance. The two-piece glass of the traditional GG architecture also causes the overall panel solution to be too heavy, which makes the OGS solution of single-sheet glass highly anticipated. Many markets Analysts all believe that OGS will shine in future notebook and All-in-one PC applications.

The best size / cost check solution

From the perspective of the touch interface market alone, the current touch technology in the consumer market is already dominated by capacitance, and the key difference between the various technologies lies in the structure of the touch sensing circuit. As the size of the touch panel is larger, the cost is higher. According to the NPD DisplaySearch survey, the cost of a touch panel for a laptop with a size of more than 10 inches will be at least US $ 40 ~ 70 without full-fitting, plus Win 8's touch specifications More stringent specifications have been formulated, which have raised the barriers to entry for suppliers.

However, from the perspective of comprehensive consideration of supply chain, manufacturing process, sensitivity, specifications, thickness, weight and cost, OGS is currently the best touch panel solution that can achieve a balance in performance / cost. For touch module suppliers, OGS's large sheet process (sheet type) has brought a greater test to its surface glass processing and secondary strengthening capabilities, so the integration of equipment, materials and processes are all The smooth introduction of OGS modules into large-scale applications is closely related. At present, the touch-sensing circuit structure of notebook computers is mainly based on OGS with SITO etching. The proportion of shipments in 2012 accounted for about 78%, and it is estimated that it will increase to 84% in 2013.

In the face of the upcoming high-speed growth, OGS technology is currently facing another challenge, namely how to enter the 14-inch or larger laptop and All-in-one PC markets. Cost is still the biggest threshold for emerging touch technology. In the notebook market, 14 and 15 inches account for about 70% of the total notebook shipments, so the success of this block market has become the most critical factor for OGS expansion.

In the long run, after the breakthrough of the yield rate problem, the embedded touch technology will make great progress in the field of high-end mobile phones, but the current embedded touch technology is still in the hands of large manufacturers, and many touch module manufacturers have invested The OGS program is clearly moving faster. As of now, many mid- to high-end mobile phone operators do not mind the structural strength of the OGS solution, and have adopted OGS touch panels in their high-end products, including Nokia, Sony, and HTC, while Google and HTC tablets OGS touch panels have also been adopted. In addition, mainland China's Huawei, ZTE, Lenovo, Gionee and other smart phone brands also use OGS panels.

Focusing on the huge development potential of single-chip touch solutions, Taiwanese, Korean, and mainland players are all investing heavily in research and development. Taiwanese manufacturers include large manufacturers of touch modules such as Chenhong, Shenghua, and Dahong, as well as companies such as AUO, Innolux, and Hexin; Korean manufacturers include Samsung FiberopTIcs, Melfas, LG innotek, a subsidiary of Samsung; The mainland players, including Ophelia and Truly, are also very active and fast.

Driven by the demand for thin and light end products and high resolution, resistive touch technology has rapidly shrunk in the consumer market, and projected capacitors have become the most noticed main technology. Whether it is an embedded In-cell or On-cell, or OGS, the thin and light weight is the demand, and the goal of all manufacturers is developing in the direction of medium and large size. At present, the embedded technology is still limited by the technology, and the main application is concentrated on mobile phones with a size of 4 inches or less; the traditional GG architecture is gradually being replaced by OGS and other touch panel technologies, and OGS technology can support 13 inches and larger For the size of notebook products, the development of these mainstream touch technologies in the future is quite worth looking forward to.

Development status of monolithic glass touch solution manufacturers.

We make 7.4v 2000mah to 20Ah Li Ion Battery Pack for heated clothing all types, including heated glove, heated jacket, heated coat, heated vest, heated shirt, electric heated jacket, heated pants, heated boots, heated gloves, heated underwear, heated jacket liners, heated glove liners, heated work glove, heating vest, heating clothing, heated motorcycle jacket, heated hunting jacket.

most popular model is 7.4v 2 cells battery, typical capacity 2200-2400mah, 2500-2600mah, 2900-3000mah, 3200-3400mah.

7V Heated Glove Battery,Heated Gloves Battery,Hand Warmers Battery,Warmest Gloves Battery

Asarke Industry Co., Limited , https://www.asarke-industry.com